Trying to manage your family's money with a clunky spreadsheet or, worse, a bunch of notes stuck to the fridge? It’s a recipe for disaster. Let’s be honest, modern family finances are a tangled mess of shared bills, individual spending, kids’ activities, and those big-picture goals we're all trying to hit. Without a solid system, it's easy for things to fall through the cracks, leading to arguments and stress.

That's where a good budgeting app built for families comes in. The best ones, like YNAB or Goodbudget, aren't just for tracking your own spending. They turn money management into a team sport, giving you and your partner a shared playbook to work from.

Why Modern Families Need a Budgeting App

A dedicated app does more than just track numbers; it provides a single, clear picture of your family's financial health. It’s about bringing order to the chaos and finally getting on the same page.

The Power of a Central Financial Hub

The biggest win here is creating a single source of truth for your money. No more guessing games about who paid the electric bill or trying to remember how much is left in the grocery budget. You and your partner can see everything in real-time. That shared visibility is the bedrock of building a strong financial future together.

This isn’t just a niche trend. The market for budgeting apps is exploding, set to grow by USD 335.7 million between 2025 and 2029. That’s an annual growth of 11.4%, and North America is leading the pack with 40% of the market share. What does that tell us? Families are ditching outdated methods for tools that actually work. For more on this, check out the market research from Technavio.

When all your financial info is in one place, you stop having arguments born from simple confusion. The conversation shifts from, "You spent how much on that?" to "How are we doing on our vacation savings goal?"

From Reactive Stress to Proactive Control

Let's face it, managing money without a plan often feels like you're just putting out fires. The car needs new tires, a surprise medical bill arrives, and suddenly your whole month is thrown off track. A good budgeting app helps you get ahead of the curve.

- It forces clear communication. When you can both see every transaction as it happens, you can have productive conversations about money, not accusatory ones.

- It cuts down on financial anxiety. There’s a huge sense of relief that comes from knowing exactly where your money is going. No more ambiguity, no more stress.

- It helps you hit goals faster. Whether it’s saving for a down payment or paying off debt, having a unified budget means you’re both pulling in the same direction.

Ultimately, using the right tool turns budgeting from a chore into a shared mission. It empowers you and your partner to operate as a team, which is a key part of finding the right work-life balance for modern fathers.

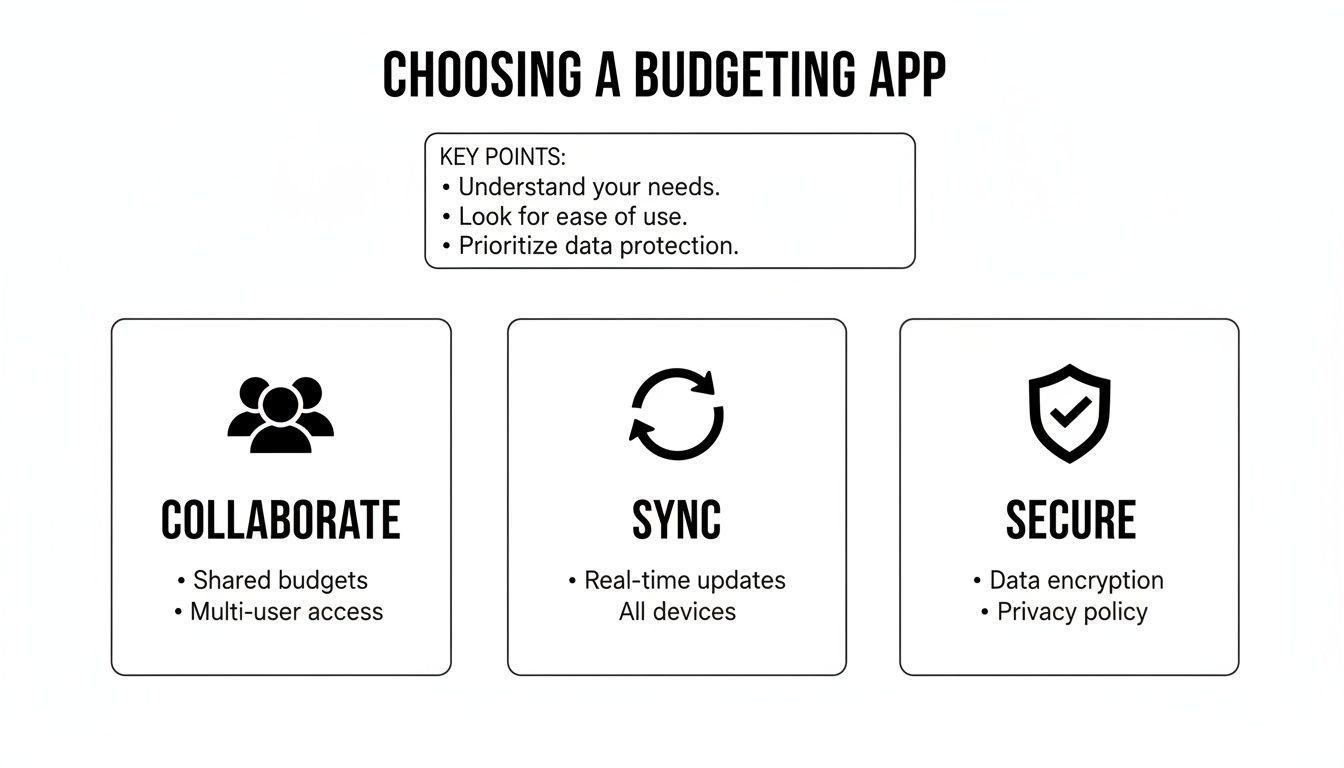

How to Pick the Right Family Budgeting App

Choosing the right budgeting tool is less about App Store ratings and more about finding a system that actually clicks with your family's daily life. Let's be honest, an app that works wonders for a single person often falls flat when you're trying to manage a shared household. The best tools are built from the ground up for collaboration, not just solo expense tracking.

Before you even start looking at apps, you need to get clear on what you're trying to solve. Are you wrestling with a variable income from a side business? Or is the main goal simply to get on the same page with your partner about everyday spending so you can finally save for that Disney trip or a kitchen remodel? Your "why" determines which features are must-haves versus nice-to-haves.

The Non-Negotiable Features for a Family App

To really get a grip on your household finances, you need more than just a pretty dashboard. It's crucial to look past the marketing fluff and focus on the core functions that actually support a shared financial life. These are the foundational pieces of any good family budgeting system.

First and foremost is seamless multi-user support. I'm not talking about sharing a password. True collaboration means both you and your partner have separate, secure access to the same, unified financial picture.

Here’s what that looks like in practice:

- Real-Time Syncing: When your partner buys groceries, that transaction should pop up on your phone instantly. This simple feature is what prevents those "oops, I thought we had more" moments and keeps you both from accidentally blowing the budget.

- Bank-Level Security: You're connecting your most sensitive accounts, so the app absolutely must use top-tier encryption (look for 256-bit) and secure protocols to keep your data safe. No compromises here.

- Customizable Categories: Your family’s spending isn't generic. You need the freedom to create budget lines for "Kids' Soccer Fees," "Summer Camp Deposits," or "Lawn Care"—stuff a standard app just won't have built-in.

This focus on shared finances is exactly why dedicated family apps are carving out their own space. They now represent a solid 20% of the budgeting app market. Digging into the data, nearly 60% of users download these apps specifically to track expenses together. With Android and iOS dominating the market at 50% and 30% respectively, these tools are available to just about everyone. You can get more details on these budget app trends from Business Research Insights.

Will Your Family Actually Use It?

Features are one thing, but how the app fits into your day-to-day is what really matters. A complicated system, no matter how powerful, will get ditched in a week. The interface needs to feel natural for everyone involved—from the dad who loves data to the partner who would rather do anything else than look at a spreadsheet.

An app's real worth is measured by one thing: consistency. If it creates more arguments than it solves, it's the wrong tool. Simplicity and a clear, shared view of your progress are what you're after.

Finally, think about that initial setup. How painful is it to link your bank accounts, create your first budget, and get your partner onboard? That first hour with the app should feel like a step forward, not a chore. It often dictates whether the tool becomes a long-term habit or gets deleted before the weekend is over.

Comparing the Top 4 Family Budgeting Apps

Alright, you know what to look for. Now it's time to put the heavy hitters under the microscope. We’re going beyond the marketing hype to give you a real, head-to-head analysis of four of the best budgeting apps for families: YNAB, Goodbudget, EveryDollar, and Monarch Money.

Each one operates on a different philosophy and comes with a unique set of tools. This isn't about finding a single "best" app—it's about finding the right fit for your family's financial style and what you're trying to achieve. We'll use our core criteria—collaboration, goal tracking, and user experience—to see how they stack up in the real world.

H3: How Well Do They Handle Collaboration?

A family budget lives or dies by how well you and your partner can work together. If an app doesn't make real-time teamwork easy, it’s basically useless as a family tool, no matter how many bells and whistles it has.

YNAB (You Need A Budget) nails this with its "YNAB Together" feature. It lets you invite up to five other people into your budget group, each with their own login. This is perfect for couples who want total transparency but still prefer their own separate access. You and your partner can both log in from your own phones, give every dollar a job, and see updates instantly without having to share passwords.

Goodbudget, on the other hand, is built around shared digital "envelopes." The whole family uses a single account that syncs across everyone's devices. When one person spends from the "Groceries" envelope, the balance updates for everyone else in real-time. It’s a beautifully simple system that perfectly mirrors the old-school cash envelope method, making it super intuitive for families who want one unified view of their money.

Monarch Money probably offers the most advanced collaboration setup. It allows multiple users with their own logins and lets you set custom permissions. You can share everything with your partner while giving older kids limited access to track their own spending. This makes it a fantastic hub for the whole family's financial life, and a great teaching tool.

Finally, EveryDollar keeps things straightforward. The premium version lets you and your partner sign into the same account on different devices. It’s not as sophisticated as YNAB or Monarch's multi-user systems, but it absolutely gets the job done and keeps both of you synced up on your family’s zero-based budget.

The personal finance software market is definitely moving in this family-first direction. North America is the biggest market for these tools, and collaborative features are a massive driver of growth. You can dive deeper into these personal finance software trends to get the bigger picture.

At the end of the day, it all comes down to three things: collaboration, real-time syncing, and rock-solid security.

Without these three pillars, even the flashiest app will fall short for managing a shared financial life.

H3: Tracking Goals and Family Milestones

Saving for the big stuff—that family trip to Disney, a down payment on a bigger house, or college funds—requires a system that makes your progress tangible and keeps you motivated. Here’s how each app tackles this critical job.

Monarch Money is the clear winner for families juggling complex financial goals. Its dashboard doesn't just track your budget; it integrates your investments to give you a complete picture of your net worth. You can create specific, long-term goals like "Hawaii Trip 2028," link savings and investment accounts directly to them, and watch your progress with detailed charts. This is tailor-made for the data-driven dad who wants to see exactly how today's saving habits are building long-term wealth.

The real game-changer for Monarch is how it visualizes progress across both savings and investments. It’s one of the few tools that connects your day-to-day budgeting discipline with your long-term financial strategy in a single, powerful dashboard.

YNAB ties goal-setting directly into its core budgeting categories. You can set targets for anything, like "Save $500/month for a New Car" or "Fully Fund Christmas by November." The app then visually nudges you to allocate money to those goals every month, making them an active part of your budget, not just a wish list. It’s an incredibly powerful method for building consistent saving habits.

EveryDollar uses a simpler approach with its "Funds" feature. You can create different savings funds for specific goals and watch your contributions add up. It’s less about complex financial projections and more about the psychological win of seeing those balances grow, which fits perfectly with its straightforward, motivational philosophy.

Goodbudget handles goals using "Goal & Annual Envelopes." You simply set a target amount for an envelope and contribute to it over time. It’s a simple but highly effective way to earmark money for big, predictable expenses like property taxes or annual insurance premiums, ensuring you’re never caught off guard.

H3: Feature Showdown The Best Budgeting Apps for Families

To make this even clearer, let's break down the key features side-by-side. This table focuses on the collaborative and family-centric tools that matter most when you're managing money with a partner.

| Feature | YNAB (You Need A Budget) | Goodbudget | EveryDollar | Monarch Money |

|---|---|---|---|---|

| Shared Access | Yes, via YNAB Together (up to 6 users, separate logins) | Yes, via a single shared account on multiple devices | Yes, via a single shared account (premium version) | Yes, multiple users with customizable permissions |

| Real-Time Sync | Excellent, instant updates across all devices | Excellent, envelope balances sync instantly | Good, syncs across devices logged into the same account | Excellent, instant sync for budget and investment data |

| Goal Tracking | Advanced, integrated into every budget category | Simple, via dedicated Goal & Annual Envelopes | Simple, via "Funds" feature for savings goals | Comprehensive, tracks savings, investments, and net worth |

| Investment Tracking | Yes, manual or linked | No | No | Yes, fully integrated and automated |

| Custom Categories | Yes, fully customizable | Yes, you create and name your own "envelopes" | Yes, fully customizable | Yes, with AI-powered suggestions |

| Best For | Hands-on budgeters who want total control | Families who love the cash envelope system's simplicity | Beginners who want a straightforward, motivational plan | Data-driven families wanting a complete financial overview |

This comparison shows there's no single right answer. The best app for you depends entirely on whether you prioritize simplicity (Goodbudget), motivation (EveryDollar), granular control (YNAB), or a high-level wealth overview (Monarch Money).

H3: User Experience and Day-to-Day Use

Let’s be honest: the best app is the one you’ll actually use consistently. A confusing interface is the fastest way to kill a new financial habit before it even starts.

- YNAB has the steepest learning curve, no question. Its proactive, four-rule methodology requires you to be actively involved. But for those who commit, it often becomes a lifelong tool. It truly forces you to be intentional with every single dollar.

- EveryDollar is built for simplicity. Its guided, zero-based budgeting process is incredibly intuitive, making it one of the easiest apps to get up and running, especially if you’re new to this.

- Goodbudget gets a lot of praise for its clean, straightforward interface. The digital envelope system is visually simple and doesn't drown you in data, making it a fantastic choice for families who want clarity without the complexity.

- Monarch Money delivers a sleek, modern dashboard that feels like a premium financial command center. It manages to present a massive amount of info—budgets, investments, goals, net worth—in a clean, digestible format. It's perfect for anyone who wants a comprehensive overview without a cluttered screen.

Which Budgeting App Fits Your Family's Scenario

Picking the right budgeting app for your family isn't about finding the one with the most bells and whistles. It’s about finding the tool that actually solves your biggest money challenges. The perfect app for a family with two steady paychecks is probably the wrong choice for a dad navigating the freelance world.

Let’s break down a few common family situations to see which app makes the most sense. Each scenario, from managing a fluctuating income to planning for college, comes with its own unique financial hurdles. By matching an app’s core strengths to your real-world needs, you can build a financial system that actually works for you and your family.

For the Gig Economy Family with Fluctuating Income

When your income is all over the place, budgeting can feel like a nightmare. One month you’re crushing it, and the next is a ghost town. This feast-or-famine cycle makes old-school monthly budgets totally useless and creates a ton of unnecessary stress.

You need a system that breaks that cycle by forcing you to plan with the money you actually have, not the money you hope to get.

Top Recommendation: YNAB (You Need A Budget)

YNAB was practically built for this exact problem. Its foundational rule, "Give Every Dollar a Job," means you only budget the cash that’s sitting in your account right now. When a client finally pays that invoice, you immediately assign those dollars to cover rent, groceries, and other immediate needs before putting the rest toward future goals.

For a family with variable income, YNAB’s method is a game-changer. It shifts your mindset from forecasting future earnings to strategically deploying the cash you have right now, creating stability even when your income isn’t stable.

This proactive approach completely smooths out the financial roller coaster. It helps you build a cash buffer during the good months to carry you through the lean ones, giving you a steady financial footing no matter what. With YNAB, you turn unpredictable income into a predictable plan.

For New Parents Juggling New Expenses

Having a baby is an incredible experience, but it also unleashes a firehose of new and often shocking expenses. All of a sudden, your budget is getting hammered by diapers, formula, and the astronomical cost of childcare. You're not just trying to pay the bills—you're trying to figure out how to start a 529 college fund when your budget has never been tighter.

You need a simple, visual way to divvy up your money for today's needs and tomorrow's goals without getting bogged down in a complicated spreadsheet.

Top Recommendation: Goodbudget

Goodbudget's digital envelope system is a lifesaver for new parents. It’s incredibly intuitive. You just create digital "envelopes" for things like "Daycare," "Baby Supplies," and "College Savings," and you and your partner can see exactly how much cash is left in each one.

- Clarity Amidst Chaos: When you're running on 3 hours of sleep, you need simple. Seeing a clear balance in your "Diapers" envelope is way easier than trying to decipher a detailed ledger.

- Shared Visibility: Both you and your partner can check the app before running to the store, which keeps you on the same page without a dozen text messages.

- Goal-Oriented Savings: Creating a "529 Contribution" envelope makes saving for college a regular, visible part of your monthly finances.

This system forces you to be intentional with your spending. If the "Date Night" envelope is empty, you know to hold off. But seeing your "Emergency Fund" envelope grow gives you some much-needed peace of mind. For more ideas on freeing up cash, our guide on how to save money on groceries has some solid tips.

For the Financially Savvy Couple Optimizing for Growth

Okay, so you and your partner have the budgeting basics down cold. You’re saving consistently, you're knocking out debt, and now you're focused on the big picture: building serious long-term wealth. The problem is, your money is scattered everywhere—checking accounts, high-yield savings, 401(k)s, brokerage accounts, you name it.

You need one single dashboard that shows you how your daily spending connects to your investment strategy and your total net worth.

Top Recommendation: Monarch Money

Monarch Money was designed for this. It goes way beyond simple budgeting and acts as a full-blown wealth dashboard for your family. It lets you track your budget, goals, investments, and net worth all in one place, giving you that 30,000-foot view.

Its dashboard is powerful because it visually connects your spending habits to your investment growth. Seeing how skipping a few expensive dinners directly contributes to hitting a net worth goal faster is incredibly motivating. Monarch bridges the gap between your day-to-day budget and your long-term wealth, making it the perfect tool for financially ambitious families.

Setting Up Your Family's Financial Hub

Picking the right budgeting app is just step one. The real game-changer is turning that app into the mission control for your family's finances. It’s less about the download and more about building a system—and new habits—that actually stick.

This is how you go from a simple expense tracker to a central hub where you and your partner can make smart, unified decisions. It takes some work upfront, but nailing this setup is what fuels lasting financial teamwork and gets you real results.

Run Your First Financial Team Huddle

Before you even think about linking a bank account, you need to get on the same page with your partner. This is non-negotiable. Money is a massive source of stress for couples—in fact, 56% of them admit to fighting about it. You can sidestep that landmine by framing this as a team project from the get-go.

Find a time to sit down together without the kids or other distractions. And whatever you do, don't call it a "budget meeting." That sounds like a trip to the principal's office. Try calling it a "goal-setting session" or our "dream-planning huddle."

The whole point of this talk is to focus on the why.

- Talk About Shared Goals: What are the big things you both want? That family trip to the mountains? Wiping out the mortgage ten years early? Setting the kids up for a debt-free education? Get excited about the possibilities.

- Frame the App as a Tool: This isn't about micromanaging every dollar. Position the app as the vehicle that helps you reach those goals faster and with way less stress. It’s about aiming your money at what you both truly value.

- Agree on Roles: Figure out who will handle the initial setup and how you'll both keep up with tracking. When it's a shared job, nobody ends up feeling like the "money cop."

The goal of this first meeting is 100% buy-in. When you're both excited about the destination, navigating the financial roadmap together becomes a collaborative adventure, not a battle of wills.

This first conversation sets the tone. It establishes the app as a tool for empowerment, not control, which is the bedrock of a healthy financial partnership.

Securely Link Your Accounts and Get Started

Once you're both on board, it's time for the technical part. Good news: modern apps make this pretty painless. Still, you want to be smart about protecting your info. The best apps use bank-level, 256-bit encryption and secure services like Plaid to connect to your accounts, which means the app itself never stores your bank login details.

First thing you should do? Enable two-factor authentication (2FA) on your budgeting app account. This is a simple but incredibly effective way to lock down your financial data.

After your accounts are linked, the app will pull in your recent transactions. It might look like a firehose of data at first, but don't get overwhelmed. Your only job right now is to review and categorize the last month of spending. This gives you a clear picture of where your money has actually been going.

Create Your Family's Core Budget Categories

Now the fun begins—telling your money where to go. Ditch the generic, default categories. A family's budget needs to reflect real life, with all its messy, wonderful, and unique expenses.

Start by building your budget around these core groups:

- Fixed Expenses: The big, predictable stuff. Think mortgage/rent, car payments, insurance, and childcare.

- Variable Necessities: These are the must-haves that change from month to month, like groceries, gas, utilities, and household supplies.

- Family & Kids: This is where you'll track school lunches, sports fees, allowances, and clothes.

- Sinking Funds: A game-changer. These are mini-savings accounts for big, planned expenses down the road. Create categories like "Car Maintenance," "Christmas Gifts," or "Summer Vacation."

- Personal Spending: This is crucial. Set aside a guilt-free amount for both you and your partner to spend however you want, no questions asked. It’s the key to preventing financial resentment.

Bringing your kids into the process can also be a huge win. Setting up categories for their allowance or savings goals is a great way to start. For more on this, check out our guide on how to teach kids about money management.

Establish a Consistent Check-In Rhythm

A budget isn't a crockpot—you can't just set it and forget it. It's a living, breathing plan that needs regular attention to work. The key is to build a consistent rhythm for checking in.

- Daily Check (2 Minutes): Each of you takes a couple of minutes to quickly categorize new transactions on your phone.

- Weekly Huddle (15 Minutes): A quick Saturday morning chat over coffee to review the week's spending, celebrate wins, and tweak things if you're off track.

- Monthly Review (30-60 Minutes): At the end of the month, take a look at the big picture. See how you did, set the budget for the next month, and check in on your progress toward those big goals.

This steady rhythm is what builds the habit. It keeps you both engaged, eliminates financial surprises, and makes sure your financial hub is always steering your family in the right direction.

Your Questions Answered: Getting Started with a Family Budgeting App

Jumping into a shared digital finance tool always brings up some important questions. Getting them answered upfront is the key to feeling confident about the system you're building for your family. This isn't just about picking an app; it's about finding a tool that makes your life easier, protects your data, and gets everyone on the same page.

Let's tackle the most common things dads wonder about before they commit.

Are These Budgeting Apps Actually Secure Enough for My Bank Info?

This is the big one, and for good reason. The simple answer is yes, the reputable apps are incredibly secure. Companies like YNAB and Monarch Money know their entire business depends on trust, so they don't mess around with security.

They use the same kind of tech your bank does to protect your information. Here's what that looks like:

- 256-bit encryption: This is the gold standard for scrambling your data, making it completely unreadable to anyone who shouldn't have access.

- Secure Connectors: Most apps use trusted third-party services like Plaid or Finicity to link to your bank. This creates a secure "handshake" without the app ever storing your actual bank username and password on its servers.

- Two-Factor Authentication (2FA): You should turn this on immediately. It adds a crucial second step to logging in, like a code sent to your phone, stopping anyone who just has your password.

Your financial data's safety is paramount. The technology these apps use is designed so that even in the unlikely event of a breach of the app's servers, your actual bank login details would not be exposed.

Before you link anything, it's always a good idea to skim an app's privacy policy. It’ll tell you exactly how they handle your data, giving you total peace of mind.

What's the Real Cost for a Good Family Budgeting App?

You'll see free apps out there, but for a family, the features you really need are almost always behind a subscription. Think of it as a small investment in your financial clarity. Free versions are okay for a test run, but they usually lack automatic bank syncing and multi-user access—the two things that are non-negotiable for a shared family budget.

Here’s a realistic breakdown of what to expect:

- Monthly Subscriptions: These usually run between $8 to $17 per month. It's a solid option if you want to try an app for a few months without locking yourself into a long-term plan.

- Annual Subscriptions: This is where you get the best value. Most companies offer a nice discount if you pay for the year upfront, with plans typically falling between $80 and $120.

When you think about what you're getting—fewer arguments about money, a clear roadmap to your goals, and a lot less stress—that subscription fee starts to look like a bargain.

How Do I Get My Partner on Board with Using a Budgeting App?

This is where strategy matters. You have to frame this as a team effort, not as you trying to control the spending. Money is a major source of conflict for 56% of couples, so presenting this as a way to reduce that friction is a great starting point.

Don't lead with the app. Lead with your shared goals. Are you guys dreaming of a big vacation, trying to kill off debt, or saving for a down payment on a house? The app is just the tool that helps you get there together.

Showcase the benefits that make life easier for both of you, like no more manual tracking and having one clear picture of your finances. Set aside some time to explore the app together, making it a joint project right from the start. When it’s about transparency and teamwork, it feels like a shared mission, not a chore.

Can I Use One of These Apps to Teach My Kids About Money?

Absolutely. In fact, it's one of the best ways to teach financial literacy. While the main dashboard is for you and your partner, you can easily use it to create real, tangible learning moments for your kids.

Here are a few practical ways to do it:

- Create Kid-Specific Categories: Make budget lines for "Johnny's Allowance," "Sarah's Savings Goal," or even a "Family Fun Money" pot they can see. This makes the concept of money visible and concrete for them.

- Involve Them in the Weekly Check-In: When you sit down for your weekly money meeting, show your older kids the progress in their categories. It’s a powerful, real-time lesson on earning, spending, and saving.

- Use Advanced Features: Some apps, like Monarch Money, let you set different user permissions. As your kids get older, you could give them view-only access to their specific spending categories, giving them ownership without handing over the keys to the kingdom.

This approach turns budgeting from some boring, abstract thing adults do into a hands-on part of their lives, setting them up with a strong financial foundation.

At alphadadmode.com, we're here to give you the tools and insights to lead your family with confidence. To get early access to our full suite of content on fatherhood, finance, and personal growth, sign up for updates today.

Stay in the loop by joining our community at https://alphadadmode.com.