Putting a family budget together really boils down to three stages: figuring out where your money is going now, picking a system that actually works for your lifestyle, and then building up your savings while knocking down debt. It’s a process that swaps financial stress for a clear-cut plan for your family’s future.

Why Every Dad Needs a Financial Game Plan

Let's be honest, trying to manage your family's money can feel like you're just winging it, especially with the cost of everything going up. This guide isn't about getting tangled up in restrictive spreadsheets; it's about creating a simple financial game plan that puts you back in the driver's seat. A budget is your roadmap.

When you have a clear, actionable plan, you can finally ditch that low-level financial stress and focus on what really matters—taking care of your family and building a secure future. Forget the complicated jargon and unrealistic expectations. This is about a straightforward system that makes your money work for you, not the other way around.

The Real Cost of Winging It

Without a plan, it's the small, unnoticed expenses that can really do the damage over time. That nagging feeling of not knowing exactly where your paycheck disappears to each month? It’s a huge source of anxiety for a lot of dads. A budget replaces that uncertainty with confidence. It empowers you to make deliberate choices, making sure your hard-earned cash is actually going toward what matters most to your family.

A budget isn’t about restriction; it’s about intention. It gives every dollar a job, turning your income into a powerful tool for building the life you want for your family.

The financial squeeze on families is getting tighter. According to the Global Family Inflation Index, the cost of essential family expenses in the US is projected to hit $82,476 by 2035. That's a massive 48% jump from 2025. What that really means is that without a solid budget, you could be facing an extra $46,556 in annual costs piling up over the next decade.

A Simple System for Financial Control

This guide breaks down the budgeting process into three manageable stages. This isn't a quick fix; it's a sustainable system designed for long-term financial health. Here’s a quick look at what we'll cover.

| The Three Phases of Creating Your Family Budget |

| :— | :— | :— |

| Phase | What It Involves | Key Outcome |

| Phase 1: Mapping | Tracking your income and getting a handle on all your expenses. | A clear, honest picture of your current cash flow. |

| Phase 2: Strategy | Choosing a budgeting method that actually fits your life. | A sustainable plan you can stick with for the long haul. |

| Phase 3: Building | Setting up savings, creating a debt repayment plan, and funding your goals. | A secure financial future and genuine peace of mind. |

By approaching your finances with a clear strategy, you shift from reacting to money problems to getting ahead of them. You’ll be ready for unexpected car repairs, have a plan to tackle credit card debt, and be able to actively save for big goals like that family vacation or your kids' education.

Building this plan also sets a powerful example for your children. For more on that, check out our guide on how to teach kids about money and start building a legacy of financial know-how.

Drawing Your Financial Map

Before you can build a budget that actually works, you have to get brutally honest about where your money is right now. Think of it like a GPS: you can't plot a route to your destination until you know your starting point.

This means getting a clear picture of two things: what’s coming in and what’s going out. It might feel like a chore, but this is hands-down the most powerful step you can take. A lot of dads are genuinely surprised by what they find.

Figure Out What’s Really Coming In

First, let's get a handle on your total household income. This isn't just your salary—it’s the full financial picture.

Pull out your last few pay stubs and look for your net income. That’s the actual cash that hits your bank account after they’ve taken out taxes, health insurance, and 401(k) contributions. It’s the only number that matters because it’s what you actually have to spend.

Then, tack on any other money flowing in. Do you or your partner have other income streams?

- Side Hustles: Got a weekend gig, do some freelancing, or flip things on eBay? Add it up.

- Partner's Income: If you’re a two-income household, make sure you’re including their net pay.

- Other Cash Flow: Don't forget things like child support, rental income, or any other regular payments you receive.

Sum it all up. That final number is the foundation for everything else we're about to do.

Follow the Money Trail

Alright, now for the part that can be a real eye-opener: tracking where every dollar goes. The goal here is just to be a detective for a month. Don't judge, don't change your habits—just observe and record.

The simplest way is to comb through your last 30-60 days of bank and credit card statements. Go line by line and start bucketing your spending into categories. Most banking apps these days even try to do this for you, which can be a good starting point.

This isn't about shaming yourself for that expensive coffee or an impulse Amazon buy. It's about gathering cold, hard data. Without it, you're just guessing, and a budget built on guesswork is doomed to fail.

As you do this, you'll see your spending naturally falls into two distinct camps.

Fixed vs. Flexible Spending

Splitting your expenses into these two groups shows you what’s non-negotiable and where you have room to maneuver.

Fixed Expenses are the bills that are pretty much the same every single month. These are the bedrock of your budget—the things you have to cover, no matter what.

- Mortgage or Rent

- Car Payments

- Insurance Premiums (Health, Auto, Homeowners)

- Childcare

- Loan Payments (Student, Personal)

- Subscriptions (Netflix, Gym, etc.)

Variable Expenses, on the other hand, are the costs that bounce around. This is where your daily decisions have the biggest impact and where you'll find the most opportunities to save.

- Groceries

- Gas

- Utilities (Electricity, Water)

- Eating Out & Entertainment

- Clothes & Personal Stuff

- Household Goods

Once you’ve tracked a full month, you'll have a complete financial map. I had a buddy, Mark, who did this and was floored to discover that forgotten subscriptions and daily lunches out were costing his family over $400 a month. He had no idea. These are the kinds of "budget leaks" this process helps you find and fix.

Some variable costs, like buying a new vehicle, can lock you into a fixed payment that shapes your budget for years. If a new set of wheels is on your radar, our guide on the best family cars can help you pick one that fits your long-term financial plan.

With this clear picture in hand, you’re ready to pick a budgeting method that actually fits your family’s life.

Picking the Right Budgeting Game Plan

Alright, you've mapped out your family's financial landscape. Now it's time to choose the system that will help you navigate it. Here's the thing: there's no single "best" way to budget. The right method is the one you'll actually stick with when life gets hectic.

Think of it less as a restriction and more as a powerful tool that fits your family's personality and financial goals. Let's look at three popular and effective methods to find the one that clicks for you.

The 50/30/20 Rule: Simple and Straightforward

If you want a solid framework without getting bogged down in every tiny detail, the 50/30/20 rule is a great place to start. It’s less about tracking every last coffee and more about ensuring your money is flowing in the right general directions.

Here’s the simple breakdown of your after-tax income:

- 50% for Needs: This chunk covers the absolute must-haves. We're talking mortgage or rent, utilities, groceries, car payments, and insurance.

- 30% for Wants: This is for everything that makes life more enjoyable—dining out, hobbies, streaming subscriptions, family vacations, and entertainment.

- 20% for Savings & Debt: The final piece is all about your financial future. This is where you'll fund your retirement accounts, build that crucial emergency fund, and aggressively pay down debt.

This method is perfect for busy dads who prefer a big-picture view. It’s flexible and pretty easy to maintain, but you have to be disciplined to keep those "wants" from sneaking into the "needs" column.

The real magic of the 50/30/20 rule is its simplicity. You don't get lost in a dozen different spending categories. Instead, you focus on the three big buckets that truly drive long-term financial health.

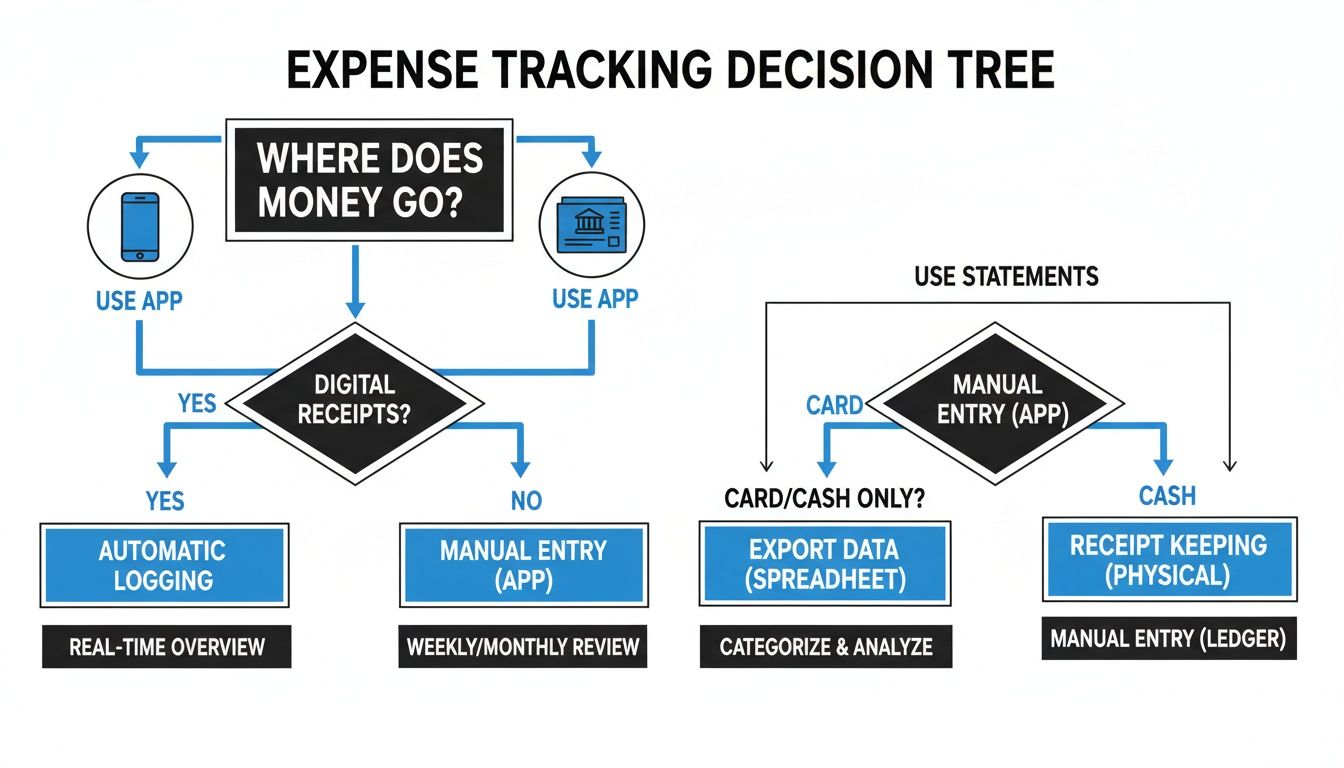

Deciding how to track your spending is just as important. Whether you're an app guy or prefer digging into bank statements, this flowchart can help you find your groove.

The key takeaway? Both digital and old-school methods work. The best one is the one you’ll actually use consistently to get a clear picture of where your money is going.

Zero-Based Budgeting: For Maximum Control

Are you the type of dad who wants to know exactly where every single dollar is headed? Then the zero-based budget is for you. The concept is simple: at the start of each month, your income minus your expenses equals zero. This doesn't mean you're broke; it means every dollar has been given a specific job.

This approach forces you to be incredibly intentional with your money. You actively decide how much goes toward groceries, savings, gas, and even that Friday night pizza tradition. Nothing is left to chance.

Zero-based budgeting is a powerhouse for families laser-focused on big goals, like wiping out debt or saving up for a down payment. It’s also incredibly effective for larger families where making every dollar count really moves the needle.

In fact, household size has a huge impact on spending. While a single person in North America spends an average of $55,760 a year, a five-person household spends about $40,400 per person—a 28% savings, according to the World Economic Forum. By giving every dollar a purpose, you can maximize those efficiencies. Just look at the real-world family of eight who managed to spend only $735 on food for a month! You can read more on the research about how households shape economics.

The Cash Envelope System: Hands-On Discipline

For any family that struggles with the siren song of the credit or debit card, the Cash Envelope System can be a total game-changer. It’s a tangible, old-school method that’s brutally effective at shutting down impulse buys.

Here’s how it works in practice:

- Spot the Problem Areas: Figure out where you tend to overspend. Common culprits are groceries, dining out, entertainment, and personal spending money.

- Stuff Your Envelopes: At the beginning of the month, pull out the cash you've budgeted for these categories and put the designated amount into labeled envelopes.

- Spend from the Envelope: When you go to the grocery store, you can only use the cash inside the "Groceries" envelope.

- When It's Gone, It's Gone: This is the most important part. Once an envelope is empty, you're done spending in that category until next month. No exceptions.

This system creates a physical barrier to overspending. You can literally see your money disappearing, which forces you to be much more mindful about each purchase. It’s a powerful psychological tool for resetting bad habits and getting back in the driver's seat.

To help you decide, let's break down the pros and cons of each approach.

Which Budgeting Method Is Right for You?

Use this table to quickly compare the top budgeting methods and find the one that aligns with your financial goals and personality.

| Budgeting Method | Best For… | Key Advantage | Potential Downside |

|---|---|---|---|

| 50/30/20 Rule | Dads who want simplicity and a big-picture view without micromanaging every purchase. | Easy to start and maintain; promotes balanced financial habits. | Can be too vague; requires discipline to keep wants from becoming needs. |

| Zero-Based Budgeting | Detail-oriented dads, families with irregular income, or those with aggressive saving/debt goals. | Gives you total control over every dollar, eliminating wasteful spending. | Time-consuming to set up and track each month; can feel restrictive. |

| Cash Envelope System | Families who struggle with overspending on debit/credit cards and need a hands-on approach. | Physically prevents overspending and forces mindful purchases. | Can be inconvenient to carry cash; not ideal for online bills or purchases. |

Ultimately, the best system is the one that feels sustainable for you and your family. Don't be afraid to try one out for a month or two and switch if it isn't working. You can even combine methods—using envelopes for "fun money" while tracking fixed expenses with an app. The goal is progress, not perfection.

Building Your Financial Fortress

Alright, you've got your income and expenses mapped out and a budgeting method in mind. Now comes the part where the real work begins—and the real progress happens. This is where we shift from just tracking money to actively building a secure future for your family. Think of it as moving from defense to offense.

This is how your budget transforms from a simple spreadsheet into a powerful tool that builds security and wealth. By making your savings and debt payments automatic, you're guaranteeing your biggest goals get tackled first, not with whatever's leftover at the end of the month.

Erecting Your Emergency Fund

First things first: the emergency fund. This is non-negotiable. It's the financial shock absorber for your family, the cash buffer that stands between an unexpected car repair and a full-blown crisis. Without it, you’re just one bad day away from wrecking your entire plan and sliding back into debt.

The goal is to sock away 3 to 6 months of essential living expenses. I'm not talking about your total income, but the bare-bones amount your family needs to survive if the paychecks suddenly stopped.

To figure out your number, add up the absolute must-pays:

- Mortgage or rent

- Utilities and insurance

- Minimum debt payments

- Groceries and gas for the cars

Got that monthly total? Multiply it by three. That’s your first major target. Open a separate, high-yield savings account just for this—don't mix it with your regular checking. Then, set up an automatic transfer. Even starting with $50 per paycheck builds momentum and gets the ball rolling.

Your emergency fund isn’t an investment; it’s insurance. It’s the money that lets you sleep at night, knowing you can handle a job loss, a medical bill, or a broken-down furnace without hitting the panic button.

Conquering Debt with a Clear Plan

With your emergency fund underway, it’s time to go to war with high-interest debt. Every dollar you pay down is a dollar freed up to build real wealth. Two battle-tested strategies dominate here, and the "best" one is the one you'll actually stick with.

| Debt Repayment Method | How It Works | Best For |

|---|---|---|

| Debt Snowball | Focus on paying off your smallest debts first, regardless of the interest rate, to score quick psychological wins. | Dads who thrive on momentum and need to see progress to stay motivated. |

| Debt Avalanche | Prioritize debts with the highest interest rates first. This approach saves you the most money in interest over time. | Dads who are driven by the math and want the most financially efficient route. |

Seriously, there’s no wrong answer here. The best plan is the one that keeps you in the fight. List out all your debts, pick your strategy, and start throwing every extra dollar you can find at that first target.

Automating Your Family's Future

The last piece of the puzzle is putting your family's long-term goals on autopilot. Stop treating retirement, college funds, or a down payment as something you'll fund with "leftover" money. That day rarely comes. Instead, make these goals fixed line items in your budget, just as important as your mortgage.

Think of your family's finances like a well-run business. A recent report on family business growth from Deloitte highlights that successful ones allocate capital with intention, leading to projected revenue growth of 84% to $29 trillion by 2030. You can apply that same CEO mindset. Diversify your budget's "portfolio" by assigning funds to needs, debt, investments, and wants to build a rock-solid financial future.

Set up automatic transfers from your checking to your savings and investment accounts for the day after you get paid. You pay your future self first. This is how you guarantee progress. You can also make a huge impact by cutting down on recurring costs—for some solid ideas, check out our guide on how to save money on groceries. This disciplined, automated approach is the secret sauce that lets regular families build serious wealth over time.

Keeping Your Budget on Track

A family budget isn’t a crockpot you can set and forget. It’s a living, breathing plan that needs regular attention to keep working for you. Life happens—cars break down, kids hit growth spurts, and utility bills spike. Staying on top of these changes is what turns a good budget into a financial powerhouse.

This process isn’t about being perfect; it’s about staying engaged. Think of it as a regular financial check-up for your family, a chance to make sure your money is still aligned with your goals.

The Monthly Budget Review

Scheduling a quick monthly review is the single best habit you can develop to make your budget last. This isn't a three-hour board meeting; it’s a focused, 20-minute chat with your partner to get on the same page. Put it on the calendar, grab a coffee, and make it a consistent routine.

The goal is to answer three simple questions:

- Where did we win? Did you come in under budget on groceries or finally hit that savings goal? Celebrate it! Acknowledging the wins keeps you both motivated.

- Where did we struggle? Maybe dining out got a little out of hand, or an unexpected car repair threw things off. This isn't about blame; it's about identifying the real pressure points in your finances.

- What do we need to adjust for next month? If you consistently overspend in one category, maybe your initial number was just unrealistic. It's okay to adjust it.

For instance, let's say you budgeted $600 for groceries but spent $750 two months in a row. It’s time to decide: do you bump the grocery budget up to a more realistic $700 and trim somewhere else, or do you get serious about finding ways to save at the store? This constant tweaking is what makes a budget stick for the long haul.

A budget isn't a judgment; it's a tool. The monthly review is where you sharpen that tool, making sure it’s still the right one for the job and adapting it to your family’s changing needs.

Making It a Family Affair

Bringing your kids into the conversation is a game-changer. You’re not just managing money; you’re teaching them crucial life skills and building a legacy of financial literacy. When kids understand the "why" behind the money choices, you get a lot more buy-in and a lot fewer battles in the checkout line.

This doesn't mean showing your five-year-old the mortgage statement. It’s all about making money concepts tangible and age-appropriate.

For Young Kids (Ages 4-7):

- Use clear jars for saving. Grab three jars and label them: "Saving," "Spending," and "Giving." When they get allowance money, help them split it up. They can literally watch their savings grow.

- Talk about needs vs. wants at the store. Explain why you’re buying milk and bread (these are needs to keep our bodies healthy) but not the giant candy bar (that's a want for a special treat sometime).

For Older Kids (Ages 8-12):

- Give them a fixed allowance for specific costs. They might be responsible for buying their own video games or movie tickets from their own money. This forces them to make choices and feel the real-world consequences of their spending.

- Involve them in planning for a family goal. If you're saving for a vacation, let them help research free activities at your destination. This directly connects the idea of saving today with a fun reward tomorrow.

By making budgeting a collaborative family habit, you transform it from a chore into a shared mission. You're not just creating a family budget; you're building a team that understands how to work together to achieve big things.

Tackling the Tough Budgeting Questions

Even the best-laid plans run into roadblocks. When you're figuring out how to manage your family's money, questions are going to come up. It's just part of the process. Here are some of the most common hurdles I see dads face, with some straight-up advice to keep you moving forward.

What's the Biggest Mistake Families Make When Starting a Budget?

Hands down, the single biggest mistake is making the budget way too strict right out of the gate. It's a classic case of trying to sprint a marathon. A lot of families decide to slash every single non-essential expense all at once, which is a recipe for burnout and feeling like you've failed before you even got started.

A budget that feels like a punishment just isn't going to stick. Instead of trying to cut out all the fun, take a different approach: just track your spending for a month. No judgment, no changes, just honest tracking. This gives you a real baseline to work from. Then, you can pick just two or three areas where you can realistically cut back.

A good budget is about making conscious choices with your money, not about constant restriction. Real financial control comes from making steady progress over time, not from hitting perfection on day one. Always build in a little room for rewards.

How Do I Budget With an Irregular Income?

When your income bounces around from month to month, the standard budgeting playbook goes out the window. The key here is to build your plan around a reliable baseline, not a hopeful average. The first thing you need to do is look back at your last six to twelve months of income and find your single lowest-earning month. That number is your new foundation.

Use that lowest income figure to build your core budget. This number has to cover all your non-negotiables: mortgage or rent, utilities, groceries, gas. Then, in the months where you earn more than that baseline, that extra cash becomes your power tool. Here's how to put it to work:

- First, top off your emergency fund. Don't do anything else until it's fully funded.

- Next, attack high-interest debt. Make aggressive, extra payments on credit cards or personal loans.

- Then, boost your long-term savings for big family goals like a down payment or college funds.

- Finally, if there's anything left, stick it in a "slush fund" to help smooth out the next lean month.

This method ensures your family's basic needs are always covered. It stops you from falling into that common trap of overspending during a good month, only to be left scrambling when things slow down.

My Partner and I Disagree on Money. How Can We Get on the Same Page?

Listen, disagreements about money are incredibly common, and they're almost never really about the dollars and cents. They're usually about different values, different fears, and the different money habits we all learned growing up. The only way through it is to talk openly and commit to finding some common ground.

Set a dedicated time to talk about your finances—call it a "money date"—and pick a calm, neutral setting. This isn't about blaming or rehashing old arguments; it's about looking forward as a team. Before you meet, have each of you write down your top three financial priorities. When you sit down and compare lists, I guarantee you'll find some overlap, whether it's getting out of debt, saving for a family vacation, or feeling more secure.

Build your budget around those shared goals first. One of the most effective tactics I've seen for reducing day-to-day friction is to build a "no questions asked" personal spending allowance for each of you right into the budget. It doesn't have to be a huge amount, but that little bit of financial freedom can make a world of difference. It lets you both make small purchases without feeling like you have to justify every penny.

What Are the Best Apps or Tools for Family Budgeting?

Honestly, the best budgeting tool is the one you'll actually stick with. There's no magic app out there. It’s all about finding a system that clicks with your personality.

For the dad who loves digging into the data and having total control, YNAB (You Need A Budget) is a fantastic choice. It's built on the zero-based budgeting method and syncs with your bank, forcing you to be really intentional with every dollar. If you just want a free, high-level look at where your money is going and your overall net worth, Mint is a solid, popular option.

For guys who want total flexibility, you can't beat a simple Google Sheets or Excel spreadsheet. You can build it from scratch and customize it to track exactly what matters most to your family. And don't ever underestimate the old-school power of the Cash Envelope System. It might seem low-tech, but it remains one of the most effective ways to get a handle on overspending in those tricky categories like groceries, dining out, and entertainment.

At alphadadmode.com, we're creating a community for dads who are ready to master their finances and lead their families with confidence. Sign up now to get early access to our full suite of tools, resources, and expert insights. Be the first to know when we launch by visiting alphadadmode.com.